Nickel Industries – 80% Interest

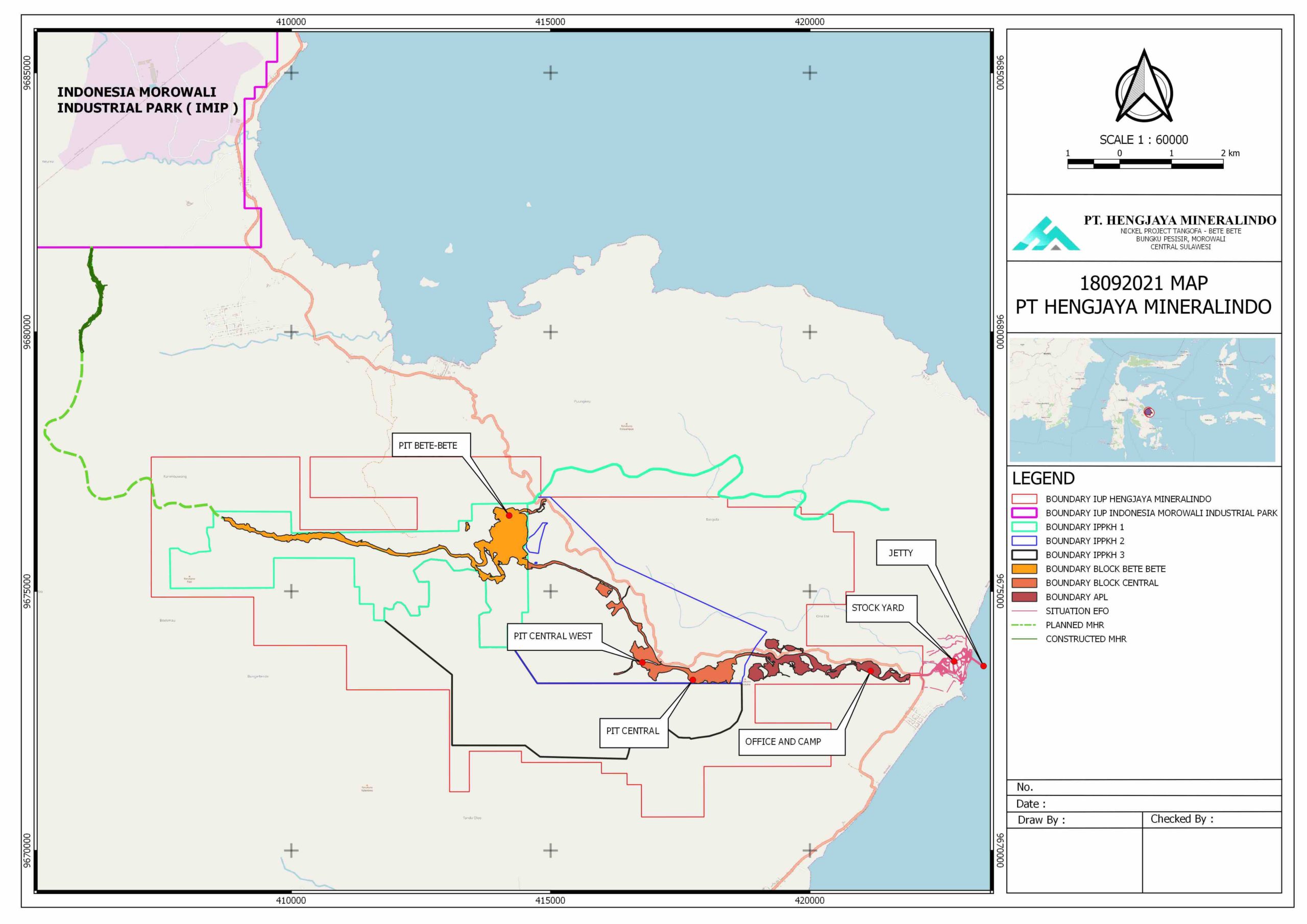

Nickel Industries holds an 80% interest in the share capital of PT Hengjaya Mineralindo (‘PT Hengjaya’), an Indonesian PMA company. The remaining 20% interest in PT Hengjaya is owned by the Company’s Indonesian partner, the Wijoyo family. PT Hengjaya holds a 100% interest in the Hengjaya Mine, located in the Morowali Regency, on the east coast of the province of Central Sulawesi, Indonesia.

The Hengjaya Mine IUP permit concession area covers 5,983 hectares. In 2012 PT Hengjaya was issued a 20-year mining operation/production licence including a further 10-year extension option.

Nickel Industries advanced the project through the various permitting, exploration, community socialisation, environmental studies and feasibility and development stages (including construction of a haul road, jetty and stockpile area) to the point where production commenced in October 2012 ahead of a maiden shipment of unprocessed ore in February 2013. A number of high-grade ore (~2%) shipments were made to China and Japan over the course of 2013.

Shortly after the introduction of the Indonesian Government’s ban on the exportation of unprocessed minerals in January 2014, production ceased at Hengjaya with Nickel Industries forced to explore in-country beneficiation options.

When Tsingshan committed to establishing a material downstream processing presence in Indonesia, requiring a reliable supply of nickel ore, production recommence in October 2015 with the Hengjaya Mine securing an offtake contract to supply a Tsingshan subsidiary 30kt/month of +1.8% ore. In October 2017 an updated offtake agreement was signed, with Tsingshan subsidiary PT. Indonesia Tsingshan Stainless Steel (ITSS) guaranteeing to take supply of 50,000 wmt per month until 31 December 2018, with a cut-off grade of 1.60% nickel.

In January 2019 commenced supplying ore to the Company’s 80% owned subsidiary Hengjaya Nickel, operator of the Hengjaya Nickel RKEF project and when the Ranger Nickel RKEF project commenced production in May 2019 the Hengjaya Mine also commenced supplying ore to Ranger Nickel.

The Hengjaya Mine is one of the only large tonnage, high grade saprolite mines in close proximity to Tsingshan’s Indonesian Morowali Industrial Park (IMIP).